Customer Equity: What It Is and How to Increase It

- February 29, 2024

- 18 mins read

- Listen

Acquiring new customers is five times more expensive than retaining existing ones that’s why more businesses focus on nurturing customer relationships as it can reduce acquisition costs considerably. When customers are retained, it shows they are happy and loyal, and also more likely to make repeat purchases. This is how a business can maximize customer lifetime value. However, all this is not possible without building customer equity.

Focusing on customer equity helps build loyal customers. It safeguards business interests by mitigating risks associated with market fluctuations. Companies that prioritize building loyalty are better able to meet customer needs and preferences, therefore improving the overall experience with the brand.

All this indicates how customer equity should be a focus area if your business prefers long-term sustainability over short-term growth. This approach can ensure consistent revenue streams and profitability over time.

In this blog, we will look at the definition of customer equity, analyze its importance, benefits, and model, and also find ways to increase it.

Before moving further, let’s start with the definition…

What is Customer Equity?

Customer equity is defined as the sum of the entire lifetime value of all customers of a business. It refers to the total profits of all customer relationships to a business. Calculated for a specific period, it’s also a measurement of the entire potential worth of a customer for the business.

For many businesses, customer equity is now a key metric to measure because it accounts for various factors, including customer lifetime value (CLV), retention rates, acquisition costs, and chances for future transactions.

More so, it’s also a measure of the long-term value that a customer adds to the business in different ways, such as through repeat purchases, referrals, loyalty, or upgrades. For a business, calculating and maximizing customer equity is key to getting insights into the overall value of their customer base.

Importance of Customer Equity

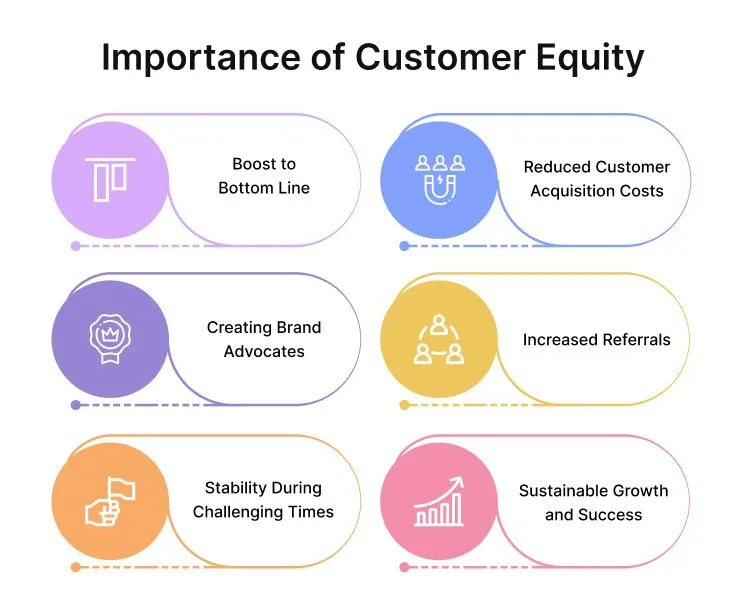

Building sustainable relationships with customers is essential for growth and success. It ensures a constant stream of revenue and provides a competitive edge in the market. However, to achieve all this, a business first needs to invest in increasing customer equity whose importance extends to many areas, including –

- Boost to Bottom Line – When customers are happy and satisfied, they stick with the business and make repeat purchases, leading to a boost to the bottom line. Such scenarios are frequent when there is an attempt to increase the total equity of a customer.

- Reduced Customer Acquisition Costs – Retaining existing customers is significantly less expensive than hiring new ones. By focusing on customer equity, a business can greatly minimize the costs associated with acquisition.

- Creating Brand Advocates – Customers become loyal when a business focuses on meeting their needs and prioritizing their preferences. Such customers can turn brand advocates for the business and bring more equity over time.

- Increased Referrals – A business that has high customer equity witnesses frequent recommendations, resulting in increased referrals and improved revenue growth.

- Stability During Challenging Times – Many businesses find it tough to adapt to market fluctuations and economic downturns due to the absence of a strong base of loyal customers. This kind of problem is not faced by companies that often invest in increasing customer relationships.

- Sustainable Growth and Success – Improving customer satisfaction is the route to fostering a customer-centric culture. This kind of culture lays the foundation for sustainable growth and success for the business.

Key Factors of Customer Equity

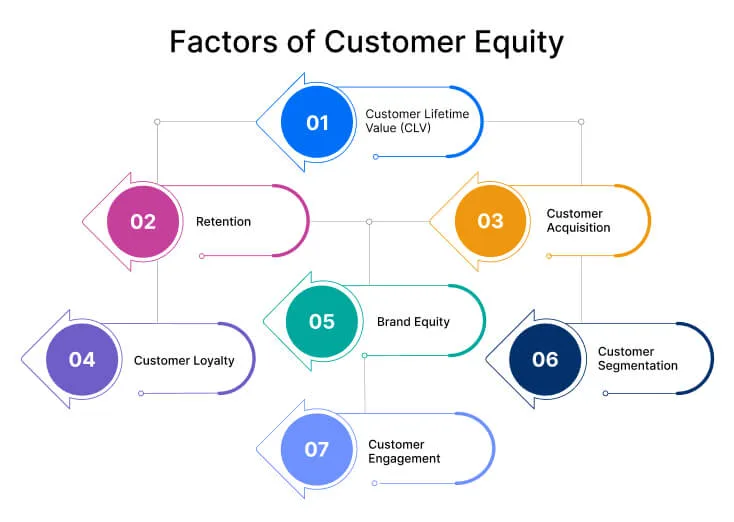

Customer equity refers to the total value of a customer base. It includes the present and future value that customers bring through their association with the business. This is how equity accumulates over time. These factors can be prioritized to drive growth and gain an edge in the market.

Let’s look at the key factors of customer equity and how you can maximize them –

- Customer Lifetime Value (CLV) – A business should focus on increasing the frequency of purchases as it has a positive effect on the equity.

- Retention – High retention rates equate to satisfied customers. So, a business should focus on retaining existing customers as it reduces acquisition costs.

- Customer Acquisition – The cost of acquisition should be in proportion to the expected lifetime value of customers as it ensures equity growth and profit over time.

- Customer Loyalty – Your business should focus on building strong relationships with customers and offer them exceptional service as it can help foster loyalty and increase equity.

- Brand Equity – Brands that have high equity enjoy customer trust and it also contributes to value creation in the long run.

- Customer Segmentation – A business that segments the audience can leverage the value of targeted marketing strategies and meet the specific needs of its audience.

- Customer Engagement – Continuous engagement through various channels is key to great experiences that lead to customer satisfaction and relationships.

Role of Customer Equity in Marketing

Customer equity is a key concept in marketing as businesses use it to focus on building and nurturing long-term relationships with their customers. Marketers often leverage it to quantify the value customers bring over time and then devise strategies to augment that value.

Here are different ways customer equity in marketing shows its relevancy –

- Marketers often use customer data to segment and identify high-value customers with the potential for long-term revenue growth and profitability.

- Most marketing strategies are based on attracting customers with the potential for term-term value and that’s why customer equity considerations are often leveraged.

- The ultimate goal of a marketing campaign is to increase the total equity customers bring to the business through personalized communication and engagement strategies.

- Customer equity insights are very helpful as marketers use them to identify chances for cross-selling and up-selling to existing customers.

- Marketers always focus on exceeding customer expectations and ensuring exceptional experiences for them. Both are crucial for maximizing customer equity.

- A marketing team can make informed decisions about resource allocation only when it’s aware of customer lifetime value.

Customer Equity Model

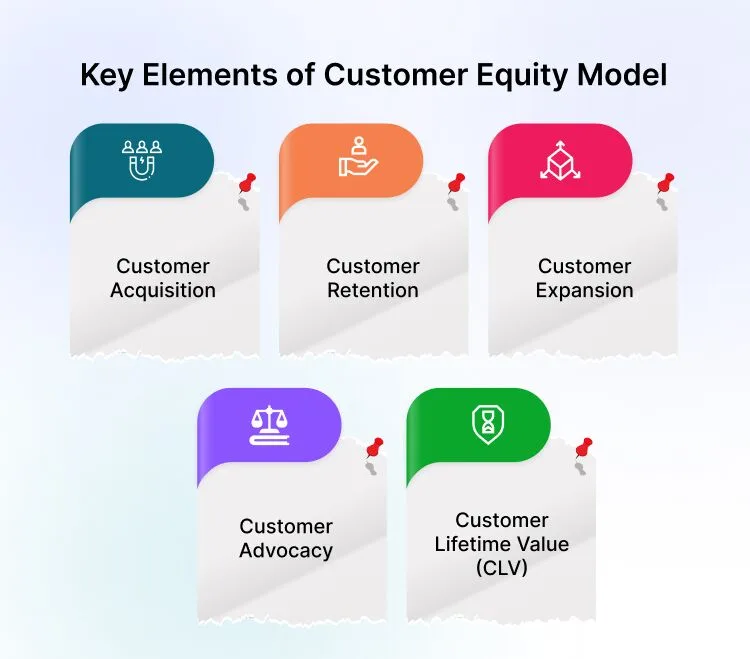

For businesses, the Customer Equity Model is a strategic framework to understand the depth and value of their customer relationships. This model helps analyze the factors that add up to the monetary worth of customers to the business. The insights gained from it can be used to drive decision-making and devise marketing tactics.

Let’s look at the key elements of the Customer Equity Model –

- Customer Acquisition – It focuses on the analysis of all the costs associated with attracting and converting customers.

- Customer Retention – It measures the value dedicated to engaging customers and keeping them happy over time.

- Customer Expansion – This element involves monetary evaluation of all the strategies to expand customer value for the business.

- Customer Advocacy – This element values the strategies aimed at encouraging and rewarding customer advocacy.

- Customer Lifetime Value (CLV) – This element estimates the total net profit generated by a customer over their entire stay with the business.

Customer Equity Formula

Customer equity is an effective metric to assess the value added by each customer to the business. This equity is calculated using a formula and the calculation is often done for a specific period.

As per the Customer Equity Formula –

Customer Equity = Viral Coefficient X Customer Lifetime Value (CLV) – (Acquisition + Retention)

In this formula, the “viral coefficient” refers to the total number of customer referrals made by a customer.

In the formula, CLV refers to the total monetary value that each customer brings to the business.

Acquisition is the total cost of attracting customers while retention is the total cost of retaining customers.

How to Calculate Customer Equity?

Customers generate equity throughout their stay with a company. To calculate this equity, it’s first important to know all the sources of that value. When the entire value source is available, a business can calculate the total equity of the customer.

Let’s look at how to calculate customer equity –

- First of all, determine the amount of money you spend on acquiring a new customer. To get this amount, you need to divide the total spending on strategies by the total customers acquired at the end of the year cycle.

- Next, establish the total money spent on customer retention strategies. This money will be added to the total acquisition cost.

- Now estimate the annual spending of each customer for each year.

- Determine the profit margin by subtracting the total cost of retention from the total cost of customer acquisition.

- Now you can list the estimated cash flow of each customer for a specific period and then add up those values to get a customer lifetime value.

How to Increase Customer Equity?

Increasing customer equity is never easy if your business does not take care of improving customer relationships. The better you build relationships, the more will be your retention rate and the lesser the acquisition rate.

Here are some of the tips to increase customer equity for your business –

1. Offer a Great Customer Experience

There is absolutely no substitute for quality interactions and excellent service. Both are key to boosting customer experience with your brand. When the customer experience is good, it always leads to improved satisfaction. With satisfied customers, you will get more repeat purchases and fewer issues with support.

However, you need to consider every stage of the customer journey and ensure that the experience is hassle-free at each stage. High-value interactions are always essential for engaging customers better no matter in which stage of the journey they are.

How to offer a great customer experience?

- Seek regular customer feedback

- Analyze areas of improvement

- Make customer experience a value proposition

2. Personalise Customer Experience

Customers like personalized interactions. They feel great when a business prioritizes connecting and engaging their customers on a personal level. The more you personalize their experience, the more you can improve their experience with your brand.

59% of customers accept that personalized engagement is the reason they may convert. Such engagement not only brings a positive impact to the sales but can also enhance a customer’s perception of your brand.

How to personalize customer experience?

- Use customer data and gain detailed insights

- Understand the wants and needs of your customers

- Analyze customer experience opportunities

3. Identify and Resolve Pain Points

Happy customers bring referrals. What about the unhappy ones? Well, they may vent their anger, and may also communicate their problems to others, and this can be damaging to your overall brand reputation. That’s why you need to focus on identifying and resolving customer pain points. A proactive approach is essential so that you can be aware of customer issues before they become a big challenge.

Many top brands make it easy for customers to get help. They also understand the value of investing in an omnichannel engagement strategy. This helps them reach customers on the channels of their choice and maintain the quality of service.

How to identify and resolve pain points?

- Analyze your customer journey and work on reducing the points of friction

- Have a robust feedback mechanism in place

- Be prompt with responses and prioritize customer experience

4. Build Customer Relationships

Have you ever wondered why some businesses perform better than others? Well, some of them understand the value of forming an emotional connection with their customers. They know how good customer relationships can form the foundation for the long-term success of the business. Maybe that’s why some brands have more loyal customers than others, and also the better CLV as well.

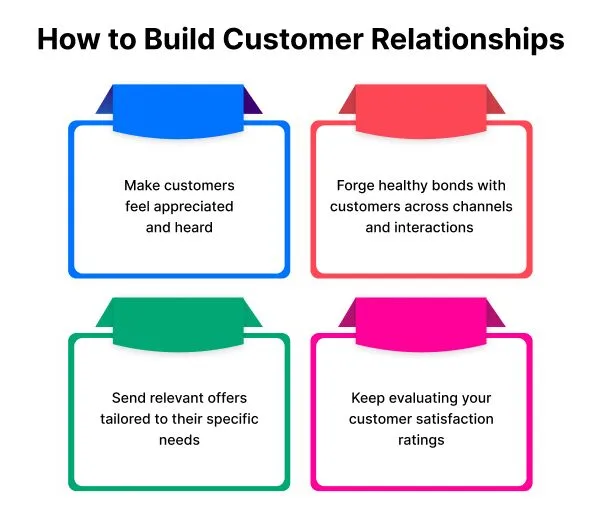

How to build customer relationships?

- Make customers feel appreciated and heard

- Forge healthy bonds with customers across channels and interactions

- Send relevant offers tailored to their specific needs

- Keep evaluating your customer satisfaction ratings

5. Provide Valuable and Engaging Content

Keeping customers engaged with your brand is vital to gaining their trust and loyalty forever. The more you engage with your customers, the more value you will get in return over time. Engaged customers often stick and make repeat purchases. Such customers are also more likely to be responsive to your offers. The key is always to provide valuable and engaging content that adds value to them and gets their attention.

How to provide engaging content?

- Know your audience and define your goals

- Create a well-planned content calendar

- Consider using email marketing

- Leverage weekly newsletters or automated drip campaigns

6. Improve Your Products and Services

Nothing else would work if your products and services lack quality. For customers, quality matters above all and they won’t feel bothered about how much you spend on marketing. Only high-quality products and services can help you improve customer equity. More so, it’s the quality of your offerings that will make customers come back to you over and again.

How to improve your products and services?

- Seek customer feedback on quality

- Implement customer feedback in product or service design

Customer Equity vs. Brand Equity

Customer equity and brand equity are two key concepts in marketing that are used to gauge the various levels of customer relationships with the business. Both are not similar and differ in scope, focus, and measurement.

Let’s look at how they are different in many ways –

| Customer Equity | Brand Equity |

|

1. Customer equity is the total combined value of a company’s lifetime customer relationships. It is the sum of the value derived from the company’s customers. This includes customer acquisition, customer retention, and customer lifetime value (CLV). And, the focus is on maximizing the long-term profitability of customers. It considers factors like customer satisfaction, loyalty, and retention rates. |

1. Brand equity refers to the value that a brand adds to a product or service beyond the functional benefits provided. It reflects the perception, trust, and recognition that the brand holds in the market. It includes brand awareness, brand associations, perceived quality, brand loyalty, and other proprietary brand assets. The focus is on the brand’s strength in the marketplace, and how well it is recognized and perceived by customers. |

|

2. It is measured through customer lifetime value (CLV), which estimates the total revenue a company can expect from a customer throughout their relationship. |

2. Brand equality can be more qualitative and subjective. Its common methods include brand valuation models, customer surveys, brand audits, and market share analysis. |

|

3. Customer equity impacts revenue and profitability by focusing on building and maintaining customer relationships. Plus, high customer equity can lead to sustainable competitive advantage through loyal customers and steady cash flows. |

3. Most importantly, it impacts a company’s ability to attract and retain customers. Brand equity often leads to increased sales and the ability to charge higher prices. In addition, it can provide resilience in competitive markets and during economic downturns. |

|

4. This prioritizes customer-centric strategies and long-term customer relationship management. The emphasis is on understanding customer needs, behaviors, and feedback. |

4. It prioritizes brand-centric strategies that enhance brand image and reputation. The emphasis is on creating strong brand associations and emotional connections with customers. |

Examples of Customer Equity

Are you looking for some amazing customer equity examples from global leading brands to get a crystal clear idea? Now let’s take a look at 5 examples from top brands and get to know how they ensure customer equity.

1. Amazon Prime Membership

Amazon Prime is a loyalty program. It offers members numerous benefits, including free two-day shipping, access to exclusive deals, and streaming of movies, TV shows, and music. They are providing substantial value through these perks, and enhancing customer satisfaction and loyalty.

Most importantly, prime members typically shop more frequently and spend more compared to non-members. This is how it significantly increases their lifetime value (CLV). This increased spending and frequent engagement with the Amazon platform contribute to higher overall customer equity, making Amazon Prime a key component of the company’s customer retention strategy.

2. Starbucks Rewards Program

Starbucks allows customers to earn stars for each purchase. This can be redeemed for free drinks and food items. This program incentivizes repeat purchases.

Also, it strengthens the emotional connection between the brand and its customers. Do you know its regular engagement through the rewards program leads to higher customer retention and satisfaction? They are just consistently bringing customers back for more purchases. Starbucks effectively boosts the lifetime value of its patrons and enhances its customer equity.

3. Apple’s Ecosystem Strategy

We are all crazy for Apple. But, do you know how they ensure customer equity? They revolve around creating an interconnected ecosystem of products and services. For example, iPhone, iPad, Mac, Apple Watch, and iCloud. This ecosystem is designed to work together. They offer a unique and cohesive user experience.

Customers who invest in one Apple product are more likely to purchase additional Apple products to enjoy the full benefits of the ecosystem. This interconnected approach increases customer satisfaction. Also, it enhances the lifetime value of each customer and significantly boosts Apple’s customer equity.

4. Costco Membership Model

Let’s take a closer look at another customer equity example, Costco. It operates on a membership-based model. Each customers pay an annual fee to access its warehouses and enjoy discounts on bulk products. This model creates a sense of exclusivity and provides significant value through cost savings on a wide range of goods. Its membership fee ensures customers are committed to shopping at Costco.

It triggers high renewal rates and frequent visits. The real value provided by the membership leads to higher customer satisfaction and loyalty. Plus, it drives up the lifetime value of Costco members. Consequently, Costco’s customer equity is significantly enhanced by this model. Just because it ensures a steady and loyal customer base.

5. Netflix Personalized Recommendations

Finally, Netflix. They use advanced algorithms to offer personalized content recommendations to their subscribers. This personalization enhances the user experience. They made it easier for subscribers to discover new content they are likely to enjoy. This effective approach increases their engagement with the platform.

They maintain high levels of customer satisfaction and retention. Do you know how? Because they adapt to individual preferences and provide a personalized viewing experience. As a result, subscribers are more likely to remain loyal to the service and continue their subscriptions. It increases their lifetime value.

Boost Customer Engagement and Equity with REVE Tools

The way you engage your audience will have a direct effect on customer equity. That’s why you should always focus on engaging better to boost the equity of customers.

At REVE, we understand the value of customer engagement and how it can drive your growth and success over time.

We have a variety of engagement tools you can use to interact with your customers well, understand their pain points, and serve their needs well.

You can use our AI-powered chatbot to automate various tasks across sales, marketing, and support. Using the powerful bot, you can respond to queries faster, put key tasks on autopilot mode, and improve customer’s experience with your brand.

We also have other useful tools for engaging customers better such as video chat software, co-browsing software, and the ticketing system.

What’s more, you can pair our live chat software with the chatbot and offer a hybrid support experience to customers.

Final Thoughts

Your company’s customer equity is a big asset as it lays the foundation for overall growth. That’s why you should focus on developing it with a sustained effort over time.

With REVE, you can find the best customer service tools and take the right steps towards improving equity.

You can sign up with us and check how our tools can add great value to your journey of enhancing customer equity.

Frequently Asked Questions

Why is Customer Equity Important?

It is crucial because it represents the total value derived from a company’s customer base. Also, it reflects the potential revenue from customer relationships over time. When companies focus on customer equity, they can enhance customer satisfaction, loyalty, and retention. This triggers sustainable long-term profitability. Plus, customer equity helps businesses understand the financial impact of their customer management strategies. And, it allocates resources effectively to maximize customer lifetime value.

What is the Customer Equity Theory?

Customer equity theory means the total value of a firm’s customers. It is the sum of the lifetime values of all its individual customers. It posits that businesses should focus on three key drivers: customer acquisition, customer retention, and customer add-on selling. When any business optimizes these areas, it can maximize the overall value of its customer base.

How Do You Solve Equity Theory?

If you want to solve equity theory issues in customer relationships, you need to ensure that customers perceive they receive fair value for their contributions. You have to gather feedback to understand their perceptions. Also, balance their purchases and loyalty with appropriate rewards like discounts and loyalty programs. Most importantly, you’ll have to communicate the benefits they receive. And, don’t forget to adjust offerings based on feedback to maintain a fair value exchange.

How to Create Customer Equity?

If you want to create customer equity you will have to offer exceptional customer service, personalize marketing efforts, and develop effective loyalty programs. Plus, you should focus on customer retention through proactive engagement and regular feedback. You can use customer insights to continuously improve your offerings. It plays a key role in long-lasting relationships and maximizing customer lifetime value.

What Are the Benefits of Customer Equity?

The key benefits of customer equity are it boosts profitability by increasing customer lifetime value (CLV) and building loyalty. It triggers repeat business and word-of-mouth referrals. It enables efficient allocation of marketing and service resources, maximizing returns. Undoubtedly, a loyal customer base provides a competitive edge and enhances the company’s market valuation.