Customer Retention Strategies for Banks (2025)

- October 26, 2023

- 11 mins read

- Listen

Banks have traditionally been good at retaining customers. However, in recent years, things have changed as banks find it tough to retain customers. In fact, customer retention strategies for banks are no longer as effective as they used to be.

The question is – why is all this happening?

Well, the banking sector is highly competitive now. Here, customers have more choices than ever before. From traditional banks to online banks, fintech firms to credit unions, there’s plenty to choose from.

Since customers have a diversity of choices, they don’t mind switching to a different bank when they don’t get the kind of service and experience desired. For banks, the key is to focus on customer-centric strategies.

It’s equally important to adapt to changing marketing conditions and live up to the ever-evolving expectations of modern customers. A bank that understands the value of great customer service and offers competitive pricing is likely to retain more customers than others.

In this blog, we will understand why banks need to focus more on customer retention than ever before, analyze some stats in this regard, and discuss the key strategies for retaining customers in banks.

But first, let’s get started with understanding the need for banks to retain customers –

Key Stats on Customer Retention in Banking

Banks have traditionally been good at retaining customers and this is a universal phenomenon cutting across regions and geography. However, in recent years, this sector has faced challenges on account of digital transformation.

Let’s look at key stats on customer retention in banking –

- The average customer retention rate for the banking industry stands at 75%. (Source)

- The Average customer attrition rate among banks per year is 15%. (FiWorks.Com)

- Over 50% of banks across the globe run loyalty programs to retain and reward customers. (Source: Capgemini)

- High-retention banks tend to achieve a 14% higher CLV. (Boston Consulting Group)

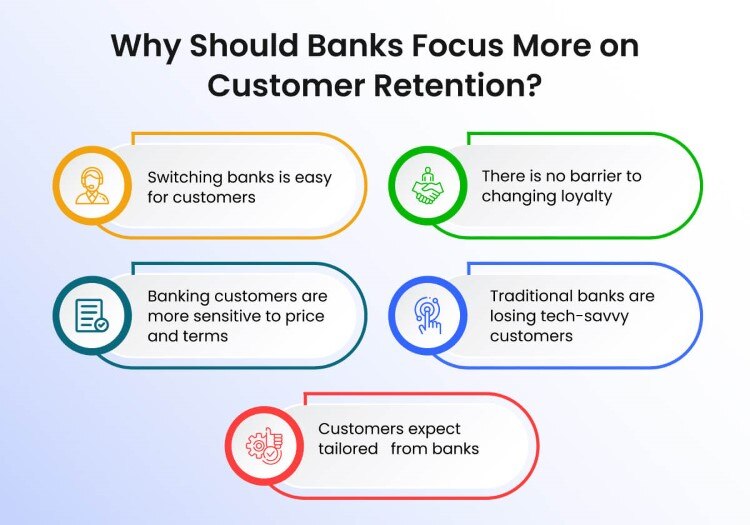

Why Should Banks Focus More on Customer Retention?

Retaining customers was easy for banks prior to the online era. The choices were less and the number of banks was not that high. Today, tons of credit unions and fintech companies offer financial services, making it difficult for banks to retain customers. The challenges are more for banks as customers have other reasons to switch.

Here are some of the key reasons why banks should focus more on customer retention –

- Switching banks is easy for customers – Banking customers are more empowered today than they were, say a decade or two ago. They have plenty of choices for financial services. With more choices at hand, customers have started expecting more from banks and when they don’t get the expected service, they switch immediately.

- There is no barrier to changing loyalty – Customers can change banks with zero hassles. They can move their account and money without facing much barriers or costs. This is why banks should focus on keeping customers happy as only this can drive retention.

- Banking customers are more sensitive to price and terms – Banking customers are very sensitive to the price and terms offered to them. They often make decisions based on the better prices delivered by banks. In fact, they might switch if a bank offers better interest rates, better loan terms, or lower fees.

- Traditional banks are losing tech-savvy customers – The banking industry is transformed now as a customer can access and manage their accounts from the comfort of their homes. Thanks to digital banking and innovations in similar technologies, banks that still rely on conventional methods may lose customers.

- Customers expect tailored experiences from banks – The new-age customers expect banking services to be tailored to their specific needs. They want customer-friendly practices to be part of the banking services. If a bank does not come good on these expectations, it may lose customers to competitors who know how to offer tailored experiences.

Customer Retention Strategies in Banking

Banks today realize the changing landscape around them. They understand how customers have more choices. So, they are facing more challenges to retain their customers. There are some great strategies that can help in retaining customers. Go through customer retention strategies for all types of businesses.

Here are some of the key tips for customer retention strategies in banking –

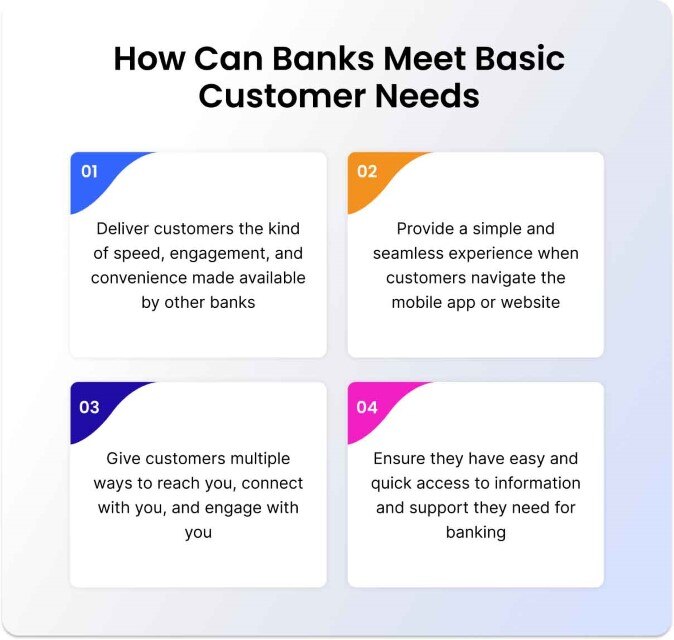

1 – Understand and anticipate customer needs

The needs of banking customers are changing at a rapid rate. Age and tech advancements are two key factors that drive the change in customer behaviors for banks. Naturally, banks need to see the change and know about these needs to better meet customer expectations.

While some needs are basic and mostly related to fraud-free services, there are others that banks need to go out of the way and meet them. Take, for example, that most customers may have event-based needs that a bank needs to anticipate and then take steps to meet those needs.

Giving convenient banking services is fine but customers these days expect a lot more in terms of services and experiences and banks need to be ready to deliver on those needs.

Tips to meet customer’s banking needs

- Make sure your customers get the kind of speed, engagement, and convenience made available by other banks

- Focus on providing a simple and seamless experience when they navigate your mobile app or website

- Give customers multiple ways to reach you, connect with you, and engage with you

- Ensure they have easy and quick access to the information and support they need for banking

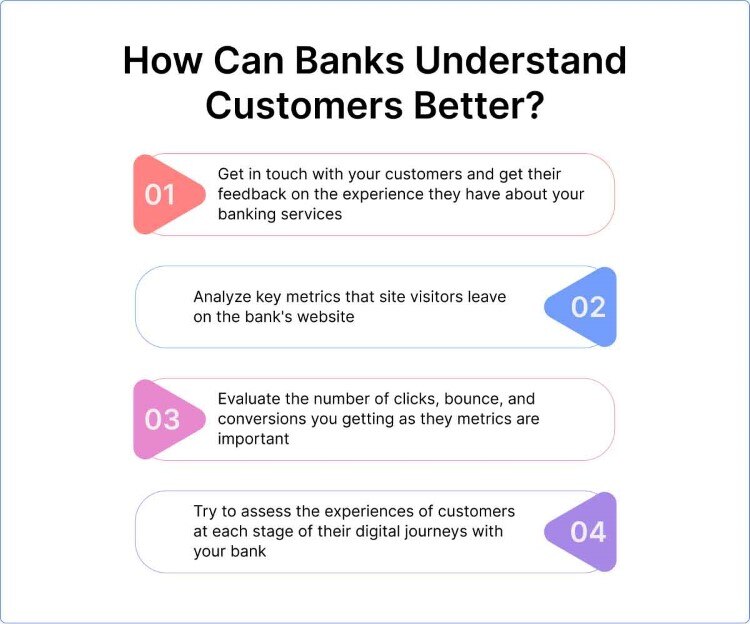

2. Use research and analytics to know your customers better

Data is key to understanding customers and their needs better. After all, customer retention today depends more on the emotion and experience they feel about a brand. If a customer is happy with the overall service of a bank, he/she is more likely to stay loyal.

You however can only deliver the best possible experience if you have data at hand and research about customers in detail. Many banks understand the value of investing in research to know the customers and their needs better and this is always a good retention strategy.

How to understand customers better?

- Get in touch with your customers and get their feedback on the experience they have about your banking services

- Analyze key metrics that site visitors leave on the bank’s website

- Evaluate the number of clicks, bounce, and conversions you getting as they metrics are important

- Try to assess the experiences of customers at each stage of their digital journeys with your bank

3. Offer your customers more value for money

Customers expect value for the money they spend. If a bank offers more value than others, chances are it will have more customers as well. Offering value at the same price can be a competitive advantage for your bank.

The key is to go beyond the core services and include additional features and value for your customers. For a bank, the priority should be on first understanding customer needs and then providing value specific to the needs.

While some customers may yearn for convenience, others will look for exceptional service delivery when they reach out to the bank. Similarly, age is also a factor in customers having a diversity of needs and requirements for their services.

Tips to offer value to your customers

- Make sure the similar products or services you offer stand out for the additional value they come with

- Give customers more choices and options so that they can feel valued and empowered

- Have a strategy for incentives, discounts, and rewards as these steps are very helpful for customer retention

- Create a customer-centric culture so that people want to bank with you

4. Personalize customer’s engagement with the bank

Offering good customer experiences is no longer enough. Today, customers expect personalized engagement with banks. They want banks and financial companies to deliver personalized interactions and meet their needs.

Now when banks have tons of customer data, it’s easy for them to understand each customer’s unique tastes and preferences and then match their needs with the right products and services.

For example, banks can analyze customer behavior and browsing patterns to personalize loans to specific needs. Similarly, banks can capture behavioral data and then target each customer specifically.

How to personalize customer experience?

- Customize your product or service to meet a customer’s unique circumstances or preferences

- Use data and analytics to meet and exceed customer’s needs

- Invest in improving customer experience at each stage of the digital journey with your bank

5. Offer consistent experience across channels

Customers feel bad when they can’t engage with banks through various channels. This dilutes their overall experience with the brand and who knows, it might cause them to leave as well. To retain such customers, it’s important to offer a simple and seamless experience to customers across multiple channels.

Similarly, banks must make it a point to keep the same messaging and communication across channels as it unifies experiences for customers. The key is to let customers enjoy all banking services from the channel they want, whether a website, mobile app, or any other channel.

Tips to offer a consistent experience across channels

- Link all the customer data to enable a hassle-free experience across channels

- Devise an omni-channel communication strategy to maintain consistency with customer messaging

6. Make your customers happy

When customers are happy, they will stick with your bank and do more business. When they are not happy, they will switch over, leaving you to lose a customer. Poor customer service is one of the leading causes of customer unhappiness and it has a big role in making customers happy or unhappy.

So, if you want to keep customers happy, make sure you offer them great service at each stage of their journey with your bank. To achieve this goal, you need to find issues that customers are facing and fix them immediately. This will make customers happy.

Some banks understand how it takes a team effort to keep customers happy, so they involve all customer service reps in this process. After all, pain points can occur at various touchpoints and unless your service reps are aware of customer issues, how could they fix the problem?

How to make customers happy?

- Deliver them quality service and engage them with the right information

- Make sure customers find it easy to access all the information related to products or service

7. Increase customer loyalty

Customer loyalty is key to retaining customers. The more loyal customers you have, the better retention rate your bank will enjoy. Plus, acquiring new customers costs way more than gaining the loyalty of an existing one.

More so, customer loyalty can increase profit and save the cost that you would otherwise have to spend on gaining new customers. This shows the value of investing in customer loyalty programs for your business.

However, it’s important to understand what makes customers stay loyal and then you can take steps in the right direction. The key is to create a loyalty program that rewards customers for continued business. Similarly, you should offer discounts or exclusive benefits for loyal customers.

Tips to increase customer loyalty

- Ensure quick and efficient issue resolution

- Implement a well-thought-out loyalty program that rewards loyal customers

- Offer exclusive perks for your loyal customers

- Be transparent about terms and conditions

Improve Customer Retention in Banking with REVE’s Engagement Tools

Engaged customers feel more satisfaction with a bank. Such customers are also more likely to be retained.

We, at REVE Chat, understand the value of customer engagement and our tools can help banks a great deal on this front.

Using our AI chatbot, automating various tasks across marketing, sales, and support is easy. With automation, customers get quick replies and they feel happy about that.

Similarly, we have video chat and co-browsing software tools for deep engagement with the audience.

Our powerful live chat can be paired with chatbots to ensure hybrid support to customers.

Final Thoughts

Customer retention is easier said than done. It involves continuous effort on the part of banks. Investing in new technologies and tools can also help retain customers.

With REVE Chat, your bank will find a range of engagement tools and make customers more happy with the banking services.

You can sign up with us and check how our tools can add great value to your core banking operations.