Customer Service in Financial Services: A Comprehensive Guide

- July 15, 2025

- 12 mins read

- Listen

In an industry built on trust and precision, even the smallest customer service misstep can lead to massive losses in revenue, reputation, and relationships. Financial services operate in a high-stakes environment where customer expectations are evolving faster than ever, and poor support is no longer an option.

As expectations rise, customer service is no longer just a support function; it’s become a core differentiator. From traditional banks to digital-first fintechs, companies are under pressure to deliver instant, personalized, and secure support across every channel. However, many still face roadblocks like legacy systems, delayed response times, and fragmented customer touchpoints that undermine the experience.

This blog dives into why customer service matters more than ever in financial services, the unique challenges businesses face, and how to build a modern, resilient support strategy that truly meets today’s demands.

What is customer service in financial services?

Customer service in financial services refers to the support provided across all client touchpoints, before, during, and after financial transactions. It spans multiple channels, in-person at branches, over the phone, via live chat, email, and increasingly through AI‑enabled chatbots.

This is especially critical in finance, where customers deal with sensitive data and high-stakes decisions. They expect fast, accurate, and empathetic service. Strong customer service not only reassures clients but also builds long-term trust, becoming a key differentiator in an increasingly competitive market.

Why does customer service matter in financial services?

Customer service matters in financial services because it builds trust and loyalty, enhances customer satisfaction, increases profitability, and more.

Trust and loyalty

Customer service builds long-term trust and increases customer loyalty by making clients feel valued and secure. In financial services, trust is everything. Transparent communication, timely support, and knowledgeable assistance help customers feel confident about their choices, encouraging them to stay loyal to the institution.

Customer satisfaction

Excellent service ensures customers feel supported and satisfied with their experience. Quick resolutions, clear guidance, and personalized interactions improve customer satisfaction, which directly impacts retention and referral rates.

Increases profitability

Better service drives higher profitability through customer retention and cross-selling opportunities. Happy customers are more likely to purchase additional financial products, remain longer with a provider, and reduce churn-related losses.

Brand reputation

Consistent, quality service enhances a financial brand’s reputation. Positive service experiences often translate into online reviews, social proof, and brand advocacy, especially important in a trust-driven industry.

Reduces issues and complaints

Proactive customer service reduces complaints and operational friction. By addressing concerns early and clearly, institutions prevent small issues from escalating into reputational or regulatory risks.

Gains a competitive advantage

Strong service gives financial companies an edge over competitors. In a crowded market with similar products, standout support can be the deciding factor for customers choosing between providers.

Adaptability to industry trends

Customer service helps financial institutions adapt to emerging trends and technologies.

With rising demand for digital, personalized, and AI-driven experiences, modern service strategies allow institutions to evolve with customer expectations.

What are the challenges for customer service in financial services?

Financial institutions face growing pressure to deliver fast, secure, and personalized support, but several challenges hold them back. From rising customer expectations to fragmented systems and evolving compliance demands, these obstacles can directly impact satisfaction, loyalty, and profitability.

Rising privacy and security demands

Financial services operate under strict regulatory pressure, especially around data protection. According to ABA Banking Journal, the average cost of a data breach in the financial industry surpassed $6 million, significantly above the global average. As threats grow more sophisticated, ensuring secure, seamless customer service is a constant, expensive challenge.

Lack of personalization

While digital banking has become the norm, it often comes at the cost of human connection. According to recent insights, 84% of customers now prefer digital banking options, but 64% feel that mobile apps fail to resolve their issues effectively. Without empathetic, real-time support, digital-only experiences can feel impersonal, especially during sensitive or complex financial situations.

Fragmented omnichannel systems

Customers expect to switch between channels, mobile, chat, and phone, without repeating themselves. Yet over 60% of support agents still lack unified access to customer data, causing delays and frustration. Disconnected systems not only reduce service efficiency but also damage customer trust, especially during high-stakes financial conversations.

Inadequate customer support

Regulatory bodies like the UK FCA and Australia’s ASIC have raised concerns about poor service for vulnerable groups, including the elderly or bereaved. In fact, reports indicate that 60% of these customers receive inadequate support. Failing to recognize emotional and situational needs can lead to reputational damage, legal scrutiny, and lost customer confidence.

7 proven strategies to improve customer service in financial services

You can improve your customer service by providing an omnichannel customer experience, personalized support, and more. Here we have compiled the best and proven strategies to improve customer service for your financial services.

1. Deliver a seamless omnichannel experience

Connecting channels smoothly builds confidence and loyalty for financial customers.

In 2026, banks that let customers hop between mobile apps, websites, branches, and call centers, without repeating themselves, gain a real edge. According to a widely cited industry report, 90% of financial services customers now expect seamless, connected experiences across all channels.

Achieving this means more than offering multiple touchpoints; it requires a centralised system where customer data follows them everywhere. That might involve bringing together interactions from live chat, co-browsing, video calls, in‑branch visits, and email into a single view.

2. Combine human agents with AI-powered chatbots

A hybrid model balances speed, scale, and empathy in financial customer service.

AI chatbots can handle FAQs, balance inquiries, loan status updates, and more, freeing human agents to manage complex or emotional cases. This hybrid model improves response times while maintaining the human touch needed for high-stakes conversations.

GenAI-powered assistants are also capable of sentiment analysis and context-aware replies, making them far more intelligent than legacy bots.

3. Use predictive analytics for personalized support

AI-driven insights enable financial brands to anticipate customer needs and tailor their services.

By analyzing user behavior, transaction history, and engagement patterns, banks can proactively alert customers about unusual spending, upcoming payments, or savings opportunities. McKinsey reports that personalization at scale can deliver a 10-15% revenue lift in banking while improving customer loyalty.

Predictive analytics can also reduce risk by flagging service pain points or dissatisfaction before they escalate.

4. Empower customers with self-service portals

Modern customers prefer solving simple issues on their own, anytime, anywhere.

Comprehensive knowledge bases, interactive FAQs, and AI-driven virtual assistants empower users to access information quickly without needing human assistance. According to Salesforce, 65% of customers prefer self-service for basic tasks.

For financial institutions, self-service tools reduce support volume, lower operational costs, and improve the digital experience across time zones and geographies.

5. Train and equip customer service agents continuously

Frontline support staff are a bank’s most important brand ambassadors.

Invest in ongoing training around financial products, digital tools, empathy, and conflict resolution. Also, equip agents with AI-augmented dashboards that surface relevant information and next-best actions in real time.

Empowered agents deliver faster, more confident support and create positive experiences that customers remember.

6. Implement real-time feedback loops

Listening to customers isn’t a one-time task. It’s a continuous process that shapes better service.

In financial services, where trust and clarity matter most, gathering real-time feedback helps uncover what’s working and what isn’t. Whether it’s after a support call, a chatbot interaction, or a digital transaction, prompting customers for quick feedback gives you direct insight into their experience.

More importantly, it allows financial institutions to act fast, adjusting processes, refining tools, or coaching support teams based on what customers actually need. When feedback is collected and acted on regularly, it doesn’t just improve service, it shows customers they’re being heard.

7. Strengthen data privacy and regulatory compliance

Great customer service begins with making people feel safe, especially with their data.

Customers expect financial institutions to treat their personal and financial information with the highest level of care. That means every touchpoint—from opening an account to contacting support- must follow strict security and compliance protocols.

But it’s not just about avoiding fines or following laws. Transparent privacy practices, clear communication about how data is used, and visible safeguards build trust. When customers know their information is protected, they’re more likely to engage, share, and stay loyal to your brand.

Examples of customer service in financial services

The following real-world examples show how financial organizations across different regions improved their customer service experience by adopting REVE Chat as their unified customer engagement platform. While the underlying technology remained the same, each organization used it in a way that suited its operational model and customer needs.

Veritas Finance

Veritas Finance is a non-banking financial company (NBFC) in India, primarily serving small businesses and self-employed individuals with credit solutions.

The challenge

With a growing customer base, Veritas was facing a surge in routine inquiries, such as EMI schedules, loan application statuses, and documentation requirements. Their support system lacked real-time responsiveness and was heavily dependent on manual responses, leading to delays and dropped queries.

The solution

To ease the pressure on agents and improve turnaround time, Veritas implemented a conversational support system combining live chat and automation across its website and mobile app. Common queries were handled instantly through AI-powered chat, while more complex cases were routed to agents who could access full conversation history and customer context.

The result

- Significantly faster response times

- Reduction in repetitive support workload

- Improved customer satisfaction, especially among first-time borrowers

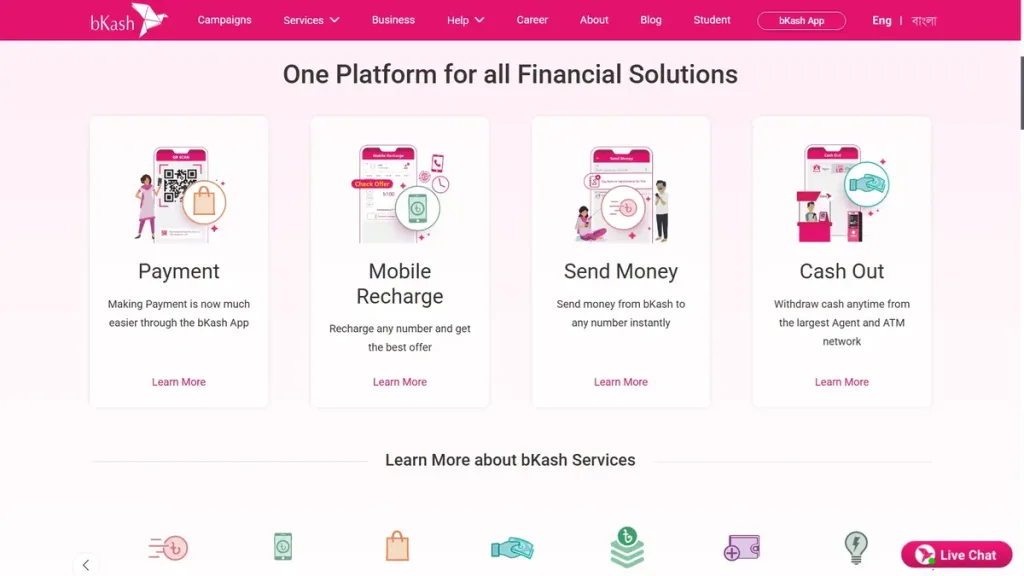

bKash

bKash is Bangladesh’s largest mobile financial services provider, offering fast, secure, and inclusive money transfers and payments.

The challenge

Supporting tens of millions of users across the country meant high volumes of customer inquiries, especially related to failed transactions, account access, and fraud alerts. The existing call center setup struggled with scale and multilingual demands.

The solution

A multi-layered support system was introduced using automation for high-frequency queries and multilingual live chat for escalations. Customers could reach out via mobile app, web, or messaging apps like WhatsApp. Real-time co-browsing and visual guidance tools helped agents resolve issues like PIN resets or suspicious activity checks faster and with less back-and-forth.

The result

- Lower call center pressure and faster resolution

- Inclusive support with local language options

- Stronger user trust due to consistent, app-integrated assistance

Top 3 customer service tools to consider for financial Services

Choosing the right customer service software can make a huge difference in how financial institutions engage, support, and retain their clients. Based on extensive reviews, here are three standout platforms ideal for the unique demands of financial services.

| Name | Best for | Rating (out of 5) | Pricing (starting) |

| REVE Chat | Financial teams need secure, AI-driven chat and unified support in one platform | 4.7 | $15 per agent/month |

| Zendesk | Scalable ticketing & automation | 4.4 | $19 per agent/month |

| Freshworks | Customizable support across channels | 4.5 | $18 per agent/month |

1. REVE Chat

REVE Chat empowers financial service providers to streamline customer interactions with AI-driven chatbots, live chat, and omnichannel messaging in a unified platform. Trusted by global banks, fintechs, and NBFCs, it offers a secure, scalable solution for delivering fast, personalized support across multiple channels.

Key features:

- AI-powered Chatbots for instant, 24/7 support

- Live Chat & Video Chat to handle complex or sensitive queries in real time

- Co-browsing to guide customers through forms, transactions, and onboarding

- Omnichannel Messaging across website, mobile app, WhatsApp, Facebook, Viber, and more

- Multilingual Support to serve diverse customer bases across regions

- Unified Dashboard for managing all conversations in one place

- Enterprise-grade Security to ensure data privacy and regulatory compliance

REVE Chat stands out as a complete solution that balances automation with a human touch, making it ideal for financial institutions aiming to build trust while improving efficiency.

2. Zendesk

Zendesk is a widely used customer support platform that helps businesses manage conversations across multiple channels. While it’s commonly used across industries, financial organizations also leverage it for handling customer requests with structured workflows and multi-channel communication.

Key features:

- Omnichannel communication via chat, email, voice, messaging, and web

- Advanced workflow automation to streamline service delivery

- Customizable dashboards & reports for real-time insight

- AI and bot capabilities through Zendesk AI and Answer Bot

- Wide integration ecosystem supporting CRMs, internal tools, and APIs

- Role-based access controls for large or multi-division service teams

3. Freshworks

Freshworks is a cloud-based customer support platform used by businesses of all sizes. It’s known for its simplicity, automation, and strong ticket management system, making it especially effective for financial service providers handling high inquiry volumes across teams and departments.

Key features:

- Robust ticketing system to track, prioritize, and resolve issues efficiently

- AI-powered automations that handle repetitive tasks and streamline workflows

- Omnichannel support across email, chat, phone, and social media

- Self-service portal with knowledge base and community forums

- Customizable SLAs & escalation rules to stay compliant and responsive

- Analytics & reporting to monitor team performance and customer satisfaction

- App marketplace & integrations for CRMs, banking tools, and more

Conclusion

Customer service in financial services has changed. It’s no longer just about answering questions; it’s about creating secure, seamless, and meaningful experiences across every channel. From proactive support to personalized automation, the strategies and tools covered in this guide reflect what modern customers truly expect from their banks, fintechs, and financial partners.

If you’re exploring how to put these ideas into action, it’s worth looking at the systems that bring them all together. With the right platform, financial teams can simplify complex support processes, respond faster, and build stronger relationships, without sacrificing control or compliance.

REVE Chat offers everything you need to do just that. From AI chatbots to co-browsing and unified messaging, it’s designed to support real-world financial service challenges. Try it free and see how your customer service can evolve.

Frequently Asked Questions

Exceptional customer service builds trust, boosts satisfaction, and increases loyalty, critical in an industry where clients value both privacy and competence. Strong support helps reduce churn, encourages repeat business, and enhances brand reputation.

Common metrics include Net Promoter Score (NPS), Customer Satisfaction (CSAT), First Response Time (FRT), Average Handle Time (AHT), and retention/churn rates—often tracked through surveys and feedback tools after each interaction.

Tools like AI-powered chatbots, omnichannel platforms, analytics dashboards, and co-browsing help increase efficiency, reduce resolution times, ensure consistency, and elevate customer trust and loyalty.

Personalization helps financial institutions tailor interactions based on customer data, preferences, and behavior. This leads to more relevant product recommendations, faster issue resolution, and a stronger emotional connection, ultimately boosting customer satisfaction and loyalty.