How to Measure Customer Loyalty (Metrics & KPIs)

- May 14, 2015

- 15 mins read

- Listen

Never before have people had this much influence on what others will buy or use, which makes customer loyalty and retention more important than ever. 82% of companies agree that retention is cheaper than acquisition.

But businesses are also curious about learning more about – how to measure customer loyalty? What are the key customer loyalty metrics and KPIs?

Do you know the reason why?

Because, time and again, it has been proven that loyal customers have a positive impact by recommending your brand to friends and family with good word of mouth. It is not just mere speculation that they contribute higher revenues for brands they are loyal to.

Evangelistic customers are much more effective in boosting the top line of a brand than marketing campaigns. Hence, businesses are putting efforts into measuring customer loyalty and improving engagement strategies.

What Is Customer Loyalty?

It is like having a favorite neighborhood café. You keep returning to them because the coffee is just right, the atmosphere is cozy, and the staff knows your name. Whenever go they make you feel delightful.

Undoubtedly. it’s that special bond between a customer and a brand where they stick with each other through thick and thin. You cannot ignore the fact that customer loyalty goes beyond just buying stuff. It’s about trust, satisfaction, and a feeling of being valued.

Customers who feel connected to a brand are more likely to choose it over competitors. They will recommend it to others, and even forgive the occasional slip-up. It’s the glue that keeps businesses and their customers happily together.

Why Measuring Customer Loyalty is Important?

Customer loyalty is a strong predictor of a business’s long-term viability because loyal customers are durable. Unlike customers who feel neutral or even negatively about a product or service, loyal customers stay associated.

Here you can see the importance of customer loyalty in a hypercompetitive market.

Loyal customers are identified to be more resistant to competitors’ marketing and more likely to purchase again, have higher average order value, and become brand advocates. By increasing loyalty, businesses activate their customers to market their products more credibly for little or no additional cost.

Businesses with a loyal customer base often enjoy:

- Measuring customer loyalty helps businesses focus on building strategies so that customers stick to the business and increase revenue growth.

- Evaluating the loyalty metrics improves brand reputation by winning the trust of loyal customers, and they are more likely to share their positive experiences across people and channels.

- Satisfied and loyal customers are cost-efficient to serve. They help to reduce customer service costs as these customers are familiar with a company’s products and services.

- Loyal will purchase more with you over time. Increasing average lifetime value is an excellent indicator of customer loyalty – when customer loyalty increases, LTV also increases.

Based on customer loyalty analysis, here are the key metrics and KPIs of how to measure customer loyalty and how you can make as part of a regular feedback loop.

Key Customer Loyalty Metrics

These metrics are like the compasses guiding businesses toward understanding how much their customers love them. How likely they are to stick around? Now let’s take a look at some key metrics of customer loyalty for your business.

- Net Promoter Score (NPS): This is like asking customers, “How likely are you to recommend us to a friend?” They rate from 0 to 10, with 9-10 being promoters, 7-8 being passive, and 0-6 being detractors. You should always subtract the percentage of detractors from the percentage of promoters to get the NPS.

- Customer Satisfaction Score (CSAT): It plays an imperative role in customer loyalty metrics. It measures how satisfied customers are with a specific interaction. It’s like a purchase or a support call. It’s usually measured on a scale from 1 to 5 or 1 to 7.

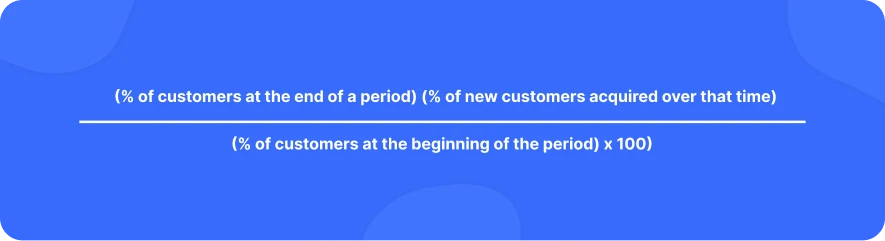

- Retention Rate: This measures how many customers stick around over a certain period. You can calculate it by dividing the number of customers at the end of the period by the number at the beginning. Afterward, you can multiply by 100 to get a percentage.

- Churn Rate: It is the opposite of customer retention. This measures how many customers leave over a period. If you want to calculate it. You’ll have to divide the number of customers lost during the period by the number at the start. Later, you can multiply by 100.

- Repeat Purchase Rate: This customer loyalty metric demonstrates how often customers come back to buy again. It’s calculated by dividing the number of customers who’ve made multiple purchases by the total number of customers.

- Customer Lifetime Value (CLV): This metric forecasts how much revenue a customer will generate over their entire relationship with the company. This key metric will help you understand the long-term value of your customers. Also, how much they should invest in retaining them?

How to Measure Customer Loyalty?

Customer loyalty can be measured in many ways depending on the business model. Based on customer loyalty analysis, here are the key metrics and KPIs of how to measure customer loyalty and how you can make as part of a regular feedback loop.

Let us go one by one.

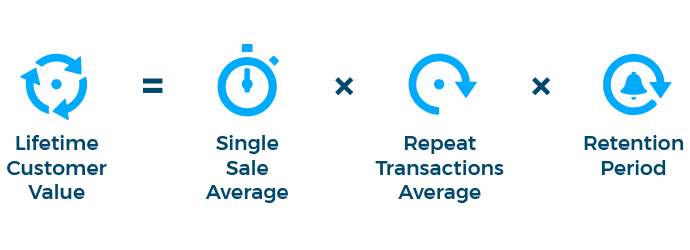

1. Customer Lifetime Value (CLV)

It is the most important customer loyalty metric that determines how valuable the customer would be to the company during the entire lifecycle.

The CLV model can be broken down as a function of three elements:

- Single sale average – refers to the single average sales made

- Repeat transactions average – indicates the total number of times the customer make a purchase each year

- Retention period – average life of customer life (in years)

The higher the CLV is, the longer the customer loyalty would be.

By using the elements CLV can be calculated entire customer base or a particular customer segment:

CLV is a good customer loyalty metric to track if your customer relationship is going to span over a couple of years. Happy customers not only spend more money by increasing your CLV but they also tell people about you. Their word-of-mouth influences 91% of purchases and generates 2x more sales than paid ads without costing you a dime.

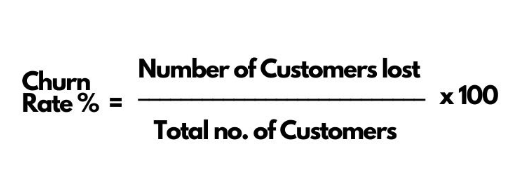

2. Customer Churn Rate (CCR)

Customer churn rate also known as the attrition rate is a great metric for gauging customer loyalty.

CCR is one of the direct customer loyalty metrics to measure the number of customers who have churned during a given period. The churn could be attributed to some reasons like:

- Improper onboarding

- Negative customer experiences

- Poor customer support

- High cost

- Unfulfilled expectations, etc.

Here is how to measure customer loyalty with the below formula.

It can be calculated by dividing the number of lost customers by the total number of customers at the beginning of the time frame.

A low CCR is indicative of higher customer loyalty because there are fewer customers lost, but a high CCR indicates a larger percentage of customers lost and implies lower customer loyalty.

Reducing the customer churn rate is one of the most crucial loyalty KPIs to be followed while evaluating your customer retention strategy.

It provides valuable insights about your customer nurturing strategies and also about the overall experience you are providing to your customers.

3. Net Promoter Score (NPS)

Net Promoter Score (NPS) is a simple yet effective metric to measure customer loyalty.

NPS survey focuses on the key question – How likely customers are to refer a brand to their friends, relatives, or colleagues on a scale from 1-10.

Based on the number the customers have chosen on the scale they will be classified as Detractors, Passives, and Promoters.

- Detractors (0-6) – Detractors are unsatisfied or frustrated customers who impact your brand with negative word of mouth.

- Passives (7-8) – Passives are your satisfied customers but are vulnerable to competitive offers and deals.

- Promoters (9-10) – Promoters are your loyal customers who continue buying as well as advocate your brand with good word of mouth.

For example – A company wants to find out the customer loyalty among the ‘X’ region. Based on that, they will conduct NPS surveys to a group of respondents in a particular region.

Suppose they receive 5000 responses from customers in the ‘X’ region and 1000 responses from customers in the ‘Y’ region. The responses can be broken further as:

NPS formula = (Number of Promoters – Number of Detractors) / (Number of Respondents) x 100

From the 5000 responses received:

- 100 responses were in the 0–6 range (Detractors)

- 500 responses were in the 7–8 range (Passives)

- 4400 responses were in the 9–10 range (Promoters)

By using the NPS formula: 4400-100/5000 *100= 86

As NPS is always shown in the whole number, it is 86.

NPS best practices:

- Determine the time and frequency of your NPS survey based on your strategic goals and your customers. Don’t send a survey too early as customers need to experience the product or brand to form a substantive opinion.

- Measure NPS regularly, not just once.

- Identify the right channels to share the NPS surveys.

- Share the NPS survey feedback with the right team to improve and deliver a better experience.

4. Customer Loyalty Index (CLI)

The customer loyalty index is a standardized tool to track customer loyalty and it incorporates the values of NPS, repurchasing, and upselling.

Key benefits of the CLI customer loyalty metric.

- Its standardization enables tracking customer loyalty over time

- Enables benchmarking – comparison to competitive products or companies.

- Finds weaknesses in customer loyalty.

Here is the process of the CLI index evaluation

Customer loyalty lies in the expression of the highest form of customer emotional adherence to the brand and business by:

- Recommending a product or service to others. If customers recommend a product or service to others, it means that they have extraordinary confidence in the value of the supplied brand or company they recommend.

- A degree of retention – ie. customers will be users of a product/ service also in the future.

- The customer is so confident about the brand/product that they could also purchase other products of the same brand.

CLI is a repetitive project, which – to capture trends, is necessary to implement based on the same methodology at regular intervals.

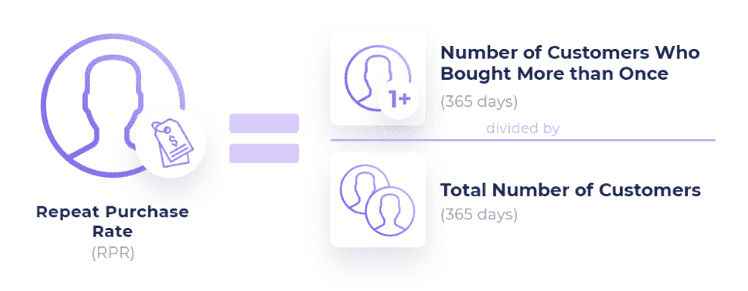

5. Repeat Purchase Rate (PPR)

Ultimately, loyal customers are the ones that make multiple purchases. Therefore, it follows that your repeat customer rate would be a great measure of customer loyalty.

RPR helps to understand how likely your customers are to return after their first purchase. Such insights can be used further for marketing campaigns to increase the number of returning customers.

It takes into account purchases from repeat customers divided by all purchases on the site for a given date range.

The calculation results range from 0% to 100% with the higher the number the better.

By using tools like Conversific, you can view in the form of simple charts that indicate your new customers vs recurring customers and figure out the percentage of repeat customer revenue.

6. Customer Retention Rate (CRR)

Customer retention rate is an important customer loyalty metrics that measure the number of customers a company retains over a given period.

To determine your retention rate, first identify the time frame you want to measure ( annual, quarterly, monthly, or weekly basis).

The SaaS companies where the user bases fluctuate very fast, it is recommended to look at this data daily. Followed with, you need to collect three simple details about customers:

- The number of existing customers at the start of the period

- The total customers at the end of the period

- How many new customers were added within the period

When you have this data, you can plug it into the retention rate formula.

How to calculate customer loyalty with the CRR metric? For example – You started the month with 200 customers. Eventually, you gained 20 customers and lost 10. This would give you the following values:

By using the CRR formula:

CRR = [(210 – 20) ÷ 200] x 100

= (190 ÷ 200) x 100

= .95 x 100

= Therefor CRR = 95%

Note – Businesses expect a CRR of 100%, but it may not be realistic. To set a target CRR, research what CRR scores are common in your industry. For example, in the SaaS industry, 35% is a good retention rate.

7. Upsell Ratio

When customers buy new products, it indicates their trust in your business. It is yet another crucial customer loyalty metric that businesses need to track. It is the ratio of customers who’ve bought multiple products to the customers who have bought only one.

This customer loyalty KPI specifically tracks the existing customers who buy a new product.

Upselling is a customer buying a higher-value option instead of the originally intended product.

Cross-selling is them buying more than the intended product. But the ratio takes these both into consideration because they are both vital components in a customer-centric relationship strategy.

Businesses would do well to focus on upselling over new acquisitions. The probability of selling to a new prospect is 5-20% and to an existing customer is 60-70%.

The success of specific upsells reduces over time with offers getting stale. By tracking the upsell ratio, you can identify when to change your upsells. It is important to keep the upsell relevant and ensure that it adds value to the user’s purchase.

How to Improve the Loyalty of Your Customers to Your Business?

Customers become loyal when they get good value from any brand. The value varies from company to company. The crux is that customers should feel they are getting exceptional value, recognize that the product is meeting their expectations, and feel resistant to switching services.

To help customers identify with a product and increase the perception of value, brands can consider the below points on how to improve customer loyalty.

1. Build a Great Product

The best offense in the game for customer loyalty is to have the best product on the market. Value speaks for itself. If your website or application is conveying your brand message and helping customers resolve their issues faster, it will attract them and keep them coming back.

When you have a strong product, here are the main benefits you witness:

- Better customer recognition – Having a strong product works to build customer recognition.

- Increased customer loyalty – Customers are attracted to brands with great products.

- More repeat purchases – When products are overall appealing, the repeat purchase rate rises.

If we talk about search engines, Google beats Yahoo by relentlessly investing its profits into improving its search algorithm to deliver more useful results. Users chose Google because it has become synonymous with finding the right answers.

2. Deliver an Excellent Customer Service Experience

Products are never able to live up to their hype. In that case, support teams should focus on providing a frictionless customer service experience and improving customer handoff. But by meeting customer expectations you can increase satisfaction but can’t build loyalty.

You have to put extra effort into exceeding your customer expectations, which proves to be worthy. You can win your customers by delighting them with your exceptional service.

Ideas you can follow:

- Add surprise discounts before your customer checks out

- Send a free gift with a customer’s order

- Empower your customer service reps to go above and beyond for customers to a limit.

- Provide new customer or user onboarding

- Offer free shipping

3. Focus on Effective Communication

The effectiveness of communication is not defined by communication but by the response. Milton Erickson.

Good and effective communication skills are key traits for improving the bottom line of every business. Whether it is internal or external, you should be able to communicate flawlessly to make it effective.

Having the right communication strategy is a great way to acquire and retain customers. Effective communication has a direct impact on the success of your business in the following ways:

- Boost customer loyalty – Having personalized conversations builds trust and loyalty with your customers.

- Faster support – Effective communication with customers helps to learn the customer problem accurately and enables you to deliver faster support.

- Reduce touchpoints – With effective communication, the number of interactions required to resolve an issue can be drastically reduced.

- Increase conversions – Helping customers in real-time helps to close sales faster and increase sales conversions.

4. Make Your Brand Stand Out

In today’s competitive market, it is really difficult to separate your products from competitors. Your most profitable product today can be suppressed tomorrow by your competitors. This is the place where customer loyalty can help you a lot.

Your brand is what differentiates you in the marketplace based on your products and services. When customers recognize and back your brand, it helps lend a competitive edge to your company. The more recognition you receive and the more you build your brand, the more you will find that your brand elevates with more loyal customers.

This is an important factor that works behind Apple’s smartphone and tablet business. Except for Apple’s incredible product design and features, it has the highest customer loyalty in smartphone and tablet business. It truly helps Apple to stand out in this crowded marketplace.

5. Reward Loyal Customers

Who does not like to be appreciated and rewarded? We all have heard about rewards for success, so why not for loyalty? So, rewarding loyal customers should be a core part of your customer loyalty programs. If your customer buys from you frequently or generates new customers for your business, they should get something for it.

Here are some ideas you can follow:

- Create early access programs for premium customers

- Invite customers to special events to spread positive goodwill

- Celebrate your customers by featuring as them for a week/month

- Give unadvertised discounts to surprise customers

Final thoughts – Customer Loyalty Analysis

Customer loyalty is a precious asset for any business. It should never be taken for granted. Using the loyalty KPIs how to measure customer loyalty will help your business in two major ways:

- Customer retention will significantly increase. The higher your customer loyalty index, the higher your will be customer retention.

- Creating a brand and understanding your customer values, helps to increase customer loyalty. This will help you to keep your customers engaged and build long-term relationships.